Arm Holdings Ltd. is eyeing a $50 billion valuation when it launches its long-awaited initial public offering, according to an updated filing Tuesday.

While it’s not the U.K.-based chip designer’s first public rodeo, the tech world has changed a lot in the past seven years since SoftBank Group Corp.

9984,

Arm

ARM,

With the 95.5 million ADS offering, that would bring the number of outstanding shares after completion of the IPO of 1.03 billion, giving SoftBank 90% of shares, according to the filing.

Two weeks prior, Arm filed paperwork for its IPO with the Securities and Exchange Commission on Monday to list shares on the Nasdaq under the ticker symbol “ARM,” with Goldman Sachs, J.P. Morgan, and BofA Securities among the underwriters.

Here are five things to know about the company from its SEC filings:

Updated: Arm confirms its roster of interested tech investors

Prior to the most recent filing, a number of large tech companies, including Amazon.com Inc.

AMZN,

In Tuesday’s filing, Arm said that Intel, Nvidia. Advanced Micro Devices Inc.

AMD,

“Because these indications of interest are not binding agreements or commitments to purchase, any of the cornerstone investors may determine to purchase more, fewer, or no ADSs in this offering, or the underwriters may determine to sell more, fewer, or no ADSs to any of the cornerstone investor,” the filing said.

We’re here because of the FTC

Call it one of Federal Trade Commission Chairwoman Lina Khan’s success stories in taking on Big Tech: Nvidia Corp.

NVDA,

Right after the breakup, SoftBank

9984,

Nvidia had hedged its bets early on, however: In 2020, Nvidia paid $750 million upfront for a 20-year license to Arm’s technology, a license that’s still in effect nearly three years later as Nvidia leads a rollout of AI hardware. Since the breakup, Nvidia shares have gained 86%, and are up more than 200% year to date.

Arm, however, noted that SoftBank will still be very much in charge after the offering.

“As long as SoftBank Group controls us and/or is entitled to certain rights under the Shareholder Governance Agreement, other holders of our ordinary shares and ADSs will have limited ability to influence matters requiring stockholder approval or the composition of our board of directors,” the company said in the filing.

Arm has yet to determine what percentage of outstanding shares SoftBank will own after the offering. Recent reports said SoftBank was in discussions to purchase the 25% stake in Arm that it does not outright own, which is held by its Vision Fund 1, ahead of the IPO.

Read from Feb. 2022: Wall Street’s reaction to death of Nvidia-Arm deal: No duh

Apple helped Arm ‘think different’ when it came to chips

Arm has quite the pedigree. It started out in 1990 as a joint venture called Advanced RISC Machines Ltd. between Cambridge, England-based Acorn Computers; San Jose, Calif.-based VLSI Technology; and what was then known as Apple Computer Inc., years prior to Steve Jobs returning to save the company he helped create.

Referred to as the British Apple, Acorn was dissolved in 2015 after being acquired by a Morgan Stanley investment subsidiary in 1999, the same year Philips Electronics bought VLSI for $1 billion. In 2006, Philips then spun off the business as NXP Semiconductors NV

NXPI,

Arm uses an architecture that is different from the once-standard x86 one introduced by Intel Corp.

INTC,

Intel’s x86-based chips use an architecture known as “complex instruction set computing,” or CISC, while Arm-based chips use one known as “reduced instruction set computing,” or RISC. CISC chips are designed with high performance and throughput in mind, so they require lots of power and generate a lot of heat. RISC chips, on the other hand, were designed with mobile performance in mind, so the emphasis is on energy efficiency to prolong battery life.

Arm licenses its chip designs, which are used mostly in low-power-consuming devices like smartphones, tablets and wearables. Apple’s foray into chip making, the M1 and the M2 used in the company’s laptops, uses Arm-based architecture.

Arm customers have shipped more than 250 billion Arm-based chips, including 30.6 billion of those in fiscal 2023. That latest figure marked a roughly 70% increase relative to fiscal 2016.

More than 260 companies reported that they had shipped Arm-based chips last fiscal year, the company said in its prospectus, calling out customers like Amazon, Alphabet, AMD, Nvidia, Intel, Qualcomm Inc.

QCOM,

Arm is profitable, but costs are soaring

Arm reported net income of $524 million, or 51 cents a share, on revenue of $2.68 billion for its March-ended fiscal 2023, compared with net income of $549 million, or 54 cents a share, on revenue of $2.7 billion, in fiscal 2022.

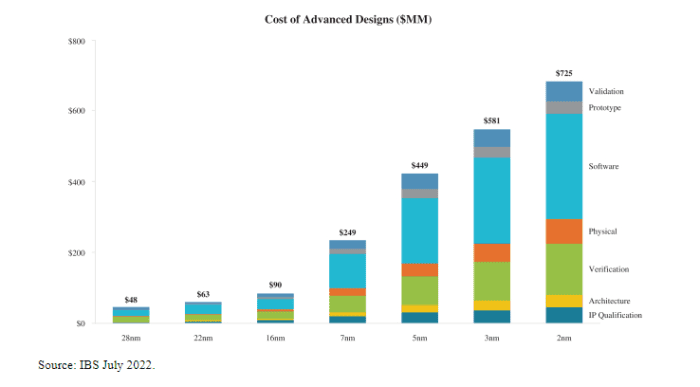

One of the reasons the company gave for going public was that the “resources required to develop leading-edge products are significant and continue to increase exponentially as manufacturing process nodes shrink.” Transistors are expressed in scales of nanometers, with design costs running at about $249 million for a 7-nanometer chip and about $725 million for a 2-nanometer chip, the company said in its filing.

Since about 80% of the company’s nearly 6,000 employees are engineers, who command fairly competitive salaries, Arm said its research and development expenses are beginning to cut more into its revenue.

In fiscal 2023, R&D costs accounted for 41% of revenue, up from 37% in 2022, and 40% in 2021. R&D costs rose 13.9% to $1.13 billion in 2023, as revenue slipped less than 1% to $2.68 billion.

As with all things chip-related, China is a risk factor, and AI might not live up to hype

Taiwan might as well be the center of the universe when it comes to the semiconductor industry with the dominance of such third-party chip fabricators like Taiwan Semiconductor Manufacturing Co.

TSM,

Given that China still considers Taiwan part of China, any flare-up in tensions between the two have the potential to inflict huge pain on the chip industry, and every industry that depends on it. The ripple effect of disruptions within the chip-industry supply chain were well on display during the COVID pandemic, and still continue to this day.

Over fiscal years 2023, 2022 and 2021, revenue from China-based customers accounted for about 25%, 18% and 20%, respectively, of Arm’s total. Revenue from Taiwan-based customers accounted for 13.4%, 15.9%, and 15.1%, respectively.

For the first quarter of fiscal 2024, however, Taiwan accounted for a larger share of sales, while China’s share declined. In the quarter that ended June 30, Arm reported that Taiwan accounted for 17% of its $675 million in revenue, while China accounted for 20.8%.

That looks fairly standard as Nvidia derives 21% of its revenue from China and 25.9% from Taiwan, according to FactSet data. Additionally, AMD gets 21.6% of its revenue from China, and 10% from Taiwan.

Arm, however, said it has little to no control over its business in China.

“Despite our significant reliance on Arm China through our commercial relationship with them, both as a source of revenue and as a conduit to the important [People’s Republic of China] market, Arm China operates independently of us,” the filing said.

Arm further explained: “The fact that Arm China operates independently of us exposes us to significant risks. Arm China’s value to us as a customer is dependent on Arm China’s business results, which are, in turn, subject to substantial risks that are outside of our control.”

Also, while Arm said its licensed products were “central” to the world’s transition to AI and machine learning, the technology may not live up to the hype, or if it does, Arm’s designs might not fit the resulting paradigm.

As Bernstein Research recently pointed out in a survey of the AI market, when companies like Lucent in the 1990s spent billions to build out fiber networks to accommodate dial-up networks, they did not anticipate that cable companies like Comcast Corp.

CMCSA,

“New technologies, such as AI and ML, may use algorithms that are not suitable for a general purpose CPU, such as our processors,” Arm said. “Consequently, our processors may become less important in a chip based on our products, thus eroding its value to the customer and resulting in lower revenue for us.”

“In addition, the introduction of new technologies, such as AI and ML, into our processors may increase IP, cybersecurity, operational, data protection and technological risks and result in new or enhanced governmental or regulatory scrutiny, litigation, ethical concerns, or other complications that could materially and adversely affect our business,” Arm said in its filing.

“As a result of the complexity and rapid development of new technologies, it is not possible to predict all of the legal, operational or technological risks related to use of such technologies,” the company said.